The Modern Equity Research Stack

How AI is redefining how research teams think, decide, and invest. A framework for building systems where truth is foundational, relevance is orchestrated, and insight compounds.

Equity research today is no longer about access to information — it's about orchestrating intelligence.

Analysts are overwhelmed by filings, earnings calls, alternative data, news, regulations, and real-time signals. The competitive edge no longer comes from seeing more data, but from structuring, prioritizing, and activating it faster and more reliably than others.

At its core, the modern equity research stack answers one question:

"Can I trust this insight — and act on it faster than everyone else?"

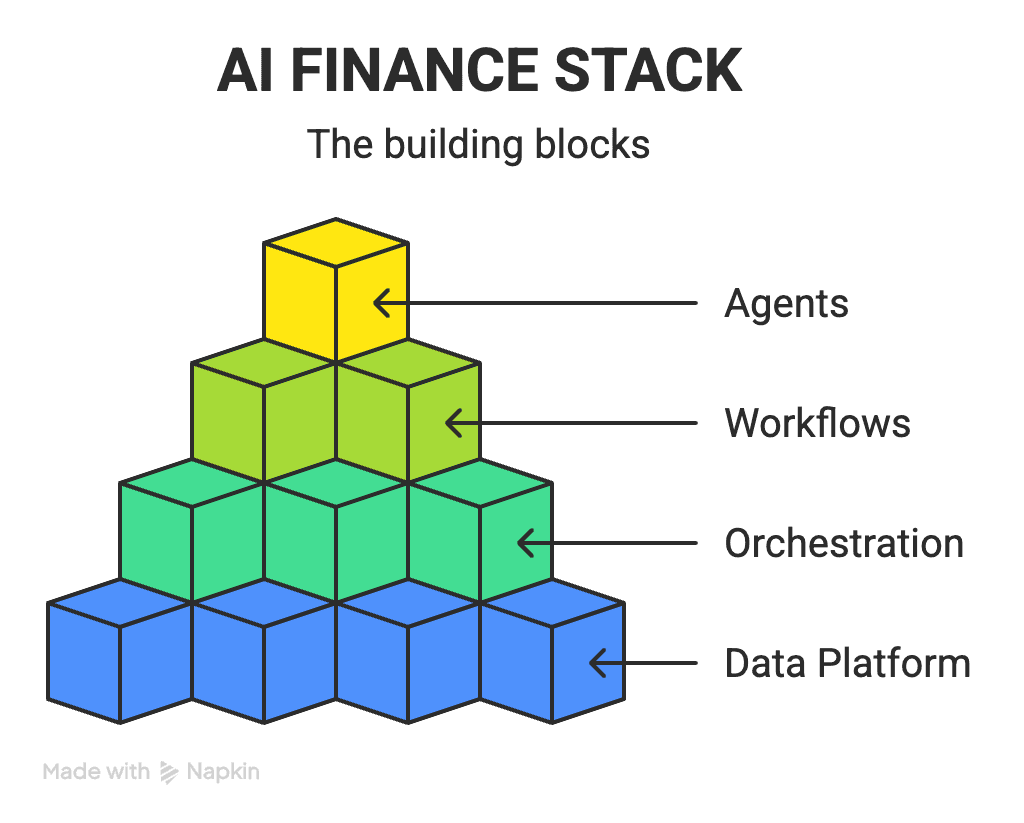

To do that, research systems must be built as a pyramid, where each layer reduces noise and increases decision confidence.

The Four-Layer Stack

1. The Data Platform — The Foundation of Truth

Every modern research system starts with a data platform designed for intelligence, not storage.

Intelligent Data Ingestion

All research begins with clean, structured ingestion:

- Financial filings, earnings transcripts, news, regulations, social and alternative data

- Parsed with correct metadata, entity resolution, and embeddings

- Designed for semantic understanding, not keyword search

Poor ingestion leads to weak correlations — and weak insights.

Knowledge Graphs That Understand Context

Once ingested, data is organized into a living knowledge graph:

- Entities: companies, executives, sectors, geographies

- Relationships: supply chains, peers, regulatory exposure

- Temporal context: what changed, when, and why

This enables cause–effect reasoning, not just retrieval.

Context, Labeling & Retrieval Logic

Every data asset is labeled so that:

- Retrieval systems fetch only relevant information

- Context sufficiency is validated before answers are generated

- No context → no output

Guardrails That Preserve Trust

Institution-grade research requires controls:

- Every claim traceable to source data

- Evidence-backed outputs

- Domain-aware logic enforcement

The Data Platform's Role

Extract signal, eliminate noise, and establish truth.

2. Orchestration — Turning Signal Into Intent

If the data platform defines what is true, orchestration decides what matters now.

This layer evaluates signals coming out of the data foundation and determines:

- Which changes are material

- Which events require action

- Which analyses should run — and in what order

Orchestration is driven by:

- Time (earnings, market open/close)

- Events (filings, guidance changes, anomalies)

- Thresholds (material KPI or valuation shifts)

Without orchestration:

- Workflows run unnecessarily

- Insights arrive too late

- Agents act on stale or irrelevant information

Key Insight

Orchestration ensures that only meaningful signals propagate upward.

3. Workflows — Where Analysis Gains Mass

Workflows are where intelligence turns into action.

Triggered by orchestration, workflows are structured, repeatable analytical processes that continuously interact with the data platform. As they run, re-run, and refine, they accumulate analytical depth.

Core Research Workflows

Morning Intelligence Briefing

- Overnight news and disclosures

- Sector and macro signals

- Regulatory and policy changes

- Delivered as signal, not noise

Bottom-Up Company Deep Dives

- Financial performance and unit economics

- Management quality and governance patterns

- Competitive positioning and growth drivers

- All grounded in verifiable data

Top-Down Sector Research

- Structural shifts and secular trends

- Peer benchmarking across key metrics

- Identifying divergence before consensus

Financial Modeling & Decision Support

- AI-assisted assumption validation

- Scenario analysis grounded in history

- Faster iteration with higher confidence

KPI Tracking Over Time

- Longitudinal monitoring

- Early detection of inflection points

- Cross-sector and custom universe comparison

Living Systems

Workflows are not static scripts — they are living analytical systems that grow more precise as new signals arrive.

4. Agents — Synthesis, Narrative, and Decision Interface

At the top of the stack sit the agents.

Agents do not create truth. They observe, synthesize, and communicate it.

Their role is to:

- Interpret workflow outputs

- Resolve ambiguity and conflicts

- Translate structured analysis into narratives, comparisons, and recommendations

- Interact with humans in natural language

Crucially, agents are constrained by the layers below:

- No direct access to raw data

- No bypassing workflows

- No unsupported reasoning

Their strength comes from standing on accumulated certainty.

The Outcome: Research That Compounds

When built as a pyramid, the modern equity research stack delivers:

- Speed without sacrificing rigor

- Depth without fragmentation

- Trust without manual verification

Analysts spend less time searching and validating — and more time thinking, debating, and deciding.

Final Thought

In the AI-first era, alpha is no longer about who has the most data.

It's about who has the best system to turn data into decisions — one where truth is foundational, relevance is orchestrated, analysis compounds through workflows, and insight is clearly expressed through agents.

Build Your Stack

The question isn't whether to adopt AI in research. It's whether your stack is designed to compound intelligence — or just process information.

Enjoyed this article?

Get more insights like this delivered to your inbox weekly.